All The Tools You Need In One Place

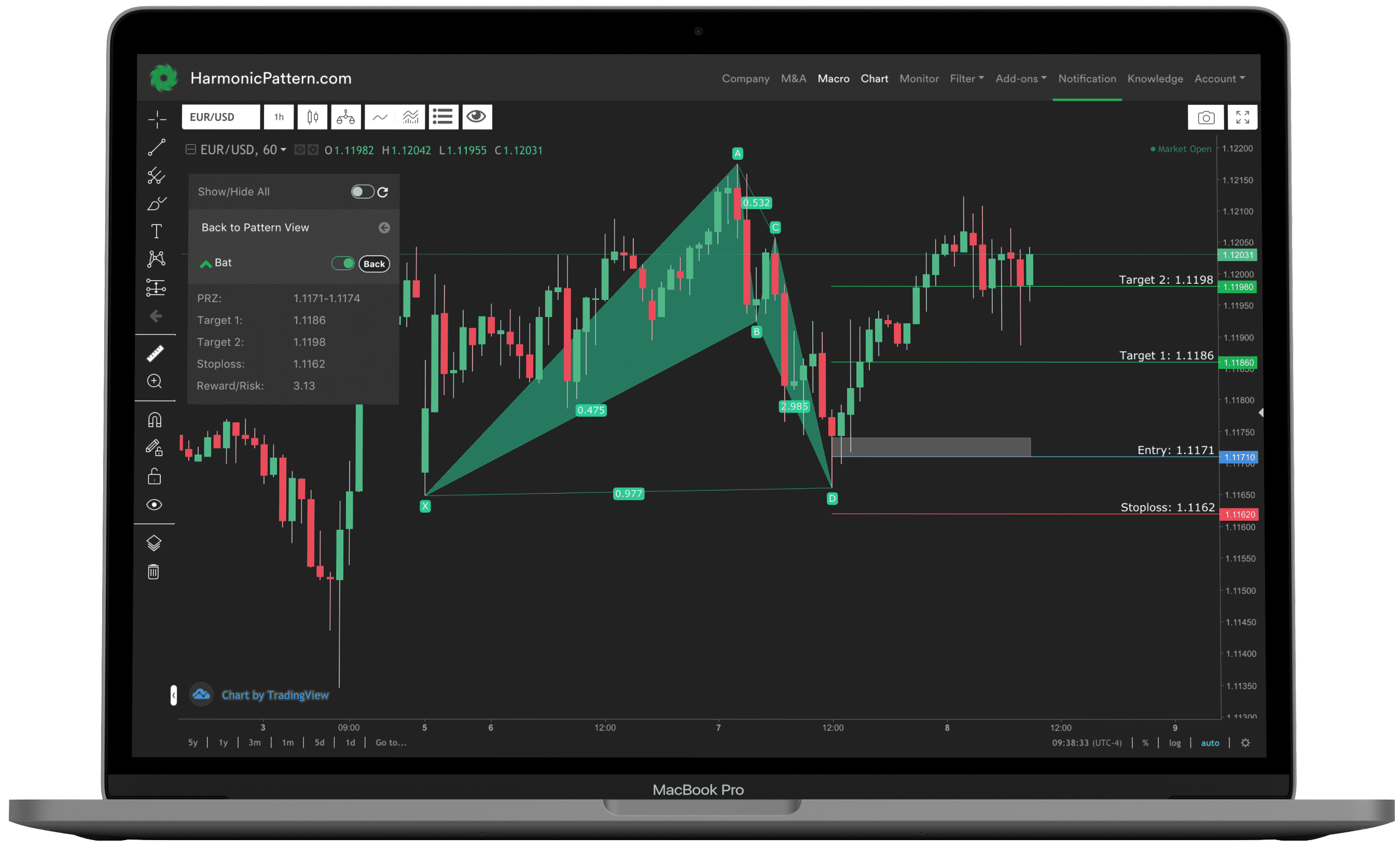

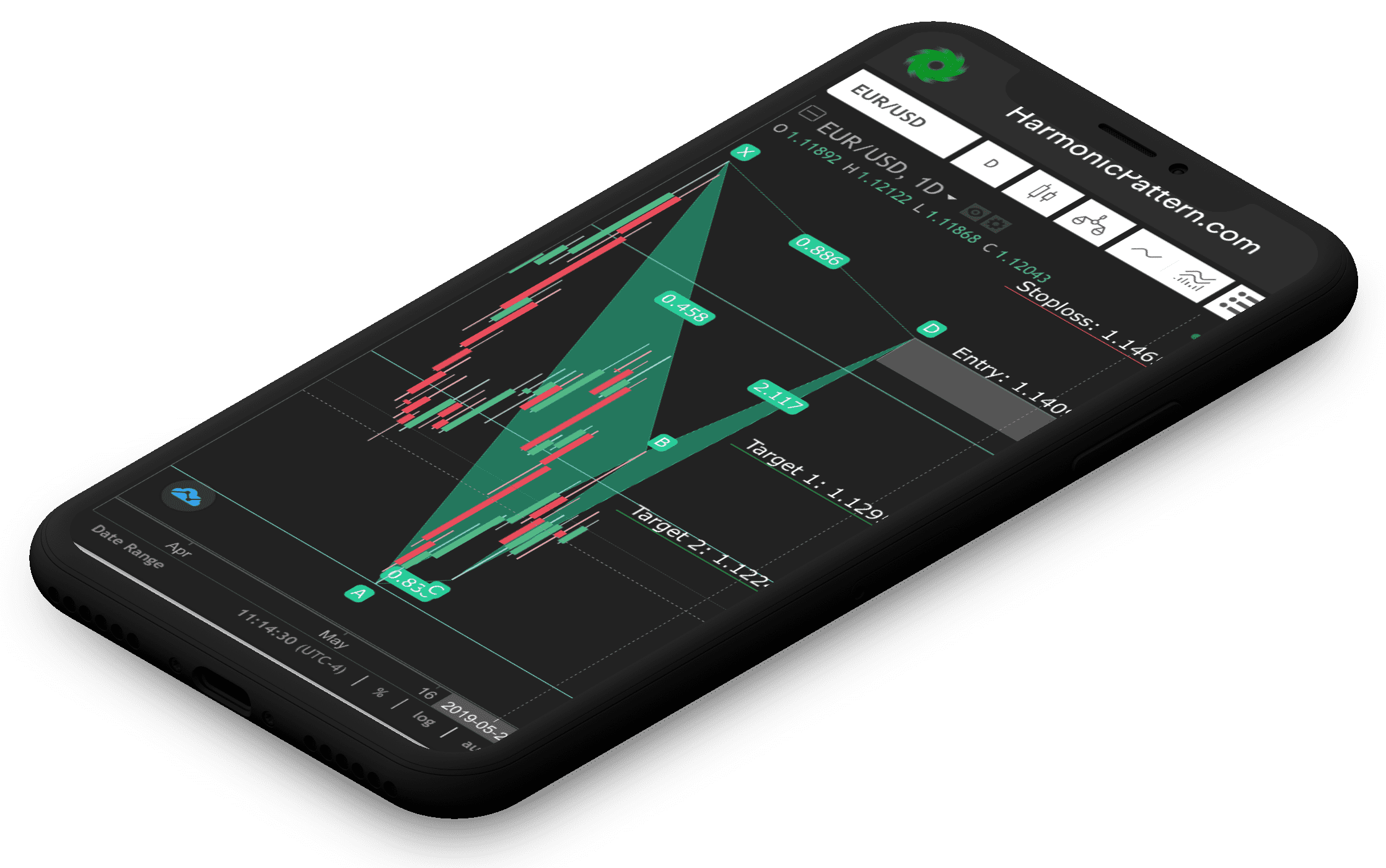

Machine Learning Pattern Recognition

We provide charting with pattern recognition algorithm for global equity, forex, cryptocurrency and futures. Get access to the most powerful pattern scanner on the market at only $19.99/month.

We support 8 harmonic patterns, 9 chart patterns and support/resistance levels detection.

Global Company Fundamentals

Access fundamental data, analyst recommendations and CEO compensation of 66,000 public companies around the world. Quickly compare and filter the best stocks in the market.

Global Economics Indicators

Access 10,000 standardized economic indicators from 200 countries gloablly.